You would be forgiven if you thought that, for want of a budget, you’re a financial hot mess. You would be forgiven if you thought that all people who have their financial acts together have and use budgets.

There’s a giant industry of finfluencers and vendors who want you to buy the budgeting app they market and choose the High Yield Savings Account they market because that’s what they can sell you. And I think, even though they’re annoying and it *is* affiliate marketing, they’re doing a service for people who are at the start of their careers. So, I’m not going to ding them for that.

But if you’ve been managing your money for years and you are participating, as recommended, in your employer-sponsored retirement plan and/or your own IRAs, a budget isn’t necessarily going to answer all your questions.

A budget will tell you where your money is going. That’s it.

Based on this information, you may choose to put your money elsewhere and have it go toward other goals. That’s called aligning your money with your values. And that’s a good thing. When you get into the habit of paying yourself first, no matter how little or how much, you will not need a budget, unless you chronically run out of money. And having too little money is a different problem than the one I suggest you solve.

If you have too little money, you know it already. You don’t need a budgeting app to tell you how much you can’t spend. I recommend fixing it by figuring out how to make more money, rather than by torturing yourself into spending less.

I hate diet mentality.

But if you are paying yourself first, and you are not running out of money, you need a tool to answer to two questions:

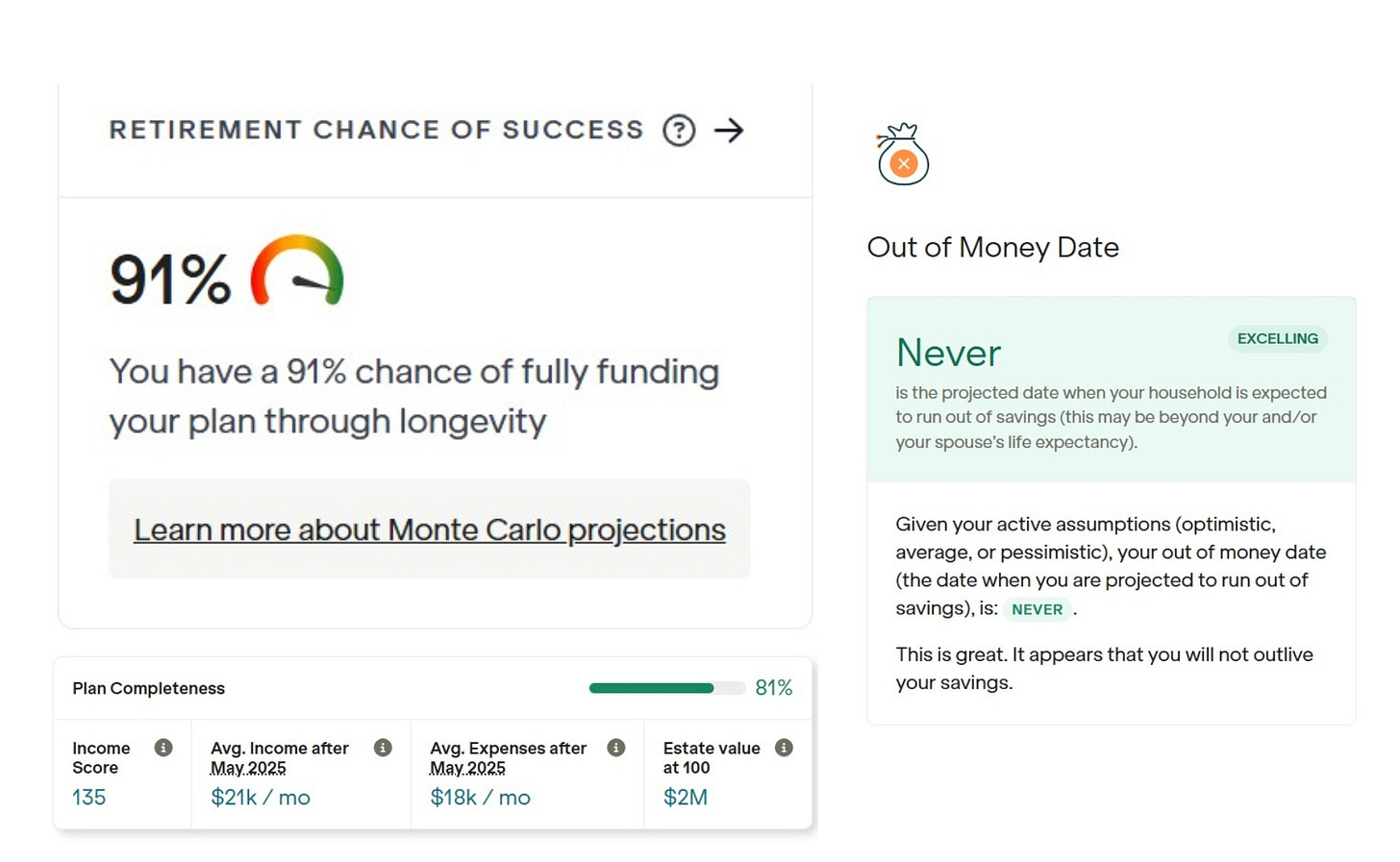

Will you have enough money to last until you are 100 years old?

How much money can you spend each month in retirement?

To answer these two questions, you need your paystub and a model. That’s it. Do NOT overcomplicate this. It’s not about understanding investments. You don’t have to learn how the stock market works to understand if you have enough based on the actions you are taking with your paycheck today.

Of course, models can tell you a lot more than just the answers to those questions. But time and again, those are the questions Madrina Molly members say they want to understand first. Every woman of a certain agency I speak to wants to know if she has enough; if she’s doing the right things; if there’s something she needs to do differently.

Every woman of a certain agency I speak to wants to sleep better at night.

Whether or not you have a financial advisor, there is nothing to keep you from getting the answers to these questions. You can even, if you are like me and have no intention of entering a detailed budget (!), get those two basic numbers for free:

Enter the information about you, your partner, and when you intend to retire.

Enter the information about your job and the contents of your paycheck (salary, 401(k) contribution, match, etc.).

Enter any account balances you have that can be used.

Let the model assume that you spend everything you don’t explicitly say you are saving.

That’s it. And voila! You will have the answer to those questions, and one of two things will be true:

You will like the answers, or you will not like the answers. I recommend you upgrade to the paid version of the model ($120/year) to tinker further:

If you like the answers, how much more can you spend and on what? Or how much sooner can you stop saving? Or how early can you retire?

If you don’t like the answers, what assumptions and corresponding actions can you change to improve the outcome?

This does not replace your relationship with your Financial Planner. It puts the controls in your hands and lets you own the assumptions. That’s powerful stuff. And if you are a DIYer, you can make the model far fancier by enacting Roth conversions, legacies, and by gaming scenarios.

Which would you prefer: A perfect budget and the stress of not knowing whether or not you have enough money? Or knowing that you have enough money and not need to do annoying things like budgeting? I know which I prefer. #WeRescueOurselves

Let me know what you think and subscribe here.

Membership includes access to me for Q&A, member Zooms, my office hours to work on your financial and longevity model, and Madrina Molly’s library of articles and mini-courses.

Copyright Madrina Molly, LLC 2025

The information contained herein and shared by Madrina Molly™ constitutes financial education and not investment or financial advice.

Sherry Finkel Murphy, CFP®, RICP®, ChFC®, is the Founder and CEO of Madrina Molly, LLC.

Hey Sherry. This fabulous. I've rarely read a writer who talk about managing money with as much clarity and straight talk as you do here. Thanks for cutting through all the noise about budgeting.