You want access to a credentialed woman CFP® to help you with the mechanics of your money.

The problem is you can’t find one.

Now you can become a member and receive on-demand help.

You want to understand Financial & Longevity Planning but you do not fit the profile to work with a high-level CFP® (Maybe you don’t have enough assets or your assets are tied up in your corporate plan or business.)

You want to understand Financial & Longevity Planning before you reach out to a Financial Advisor to ensure you are an educated client and not being ‘sold’ a financial solution; or you are a DIY financial person.

You want to understand Financial & Longevity Planning, but your Partner manages the Financial Advisor relationship.

Maybe you just hate that the industry makes you feel stupid when the reality is that their go-to-market message is intended to make you feel stupid. Not everyone. (Sigh) But too many.

The solution:

Sherry Finkel Murphy, CFP®, RICP®, ChFC® speaks your language and frames Financial & Longevity Planning concepts in ways that speak to you as a Woman of a Certain Age(ncy), as a member of the Triple-decker Club Sandwich Generation, and as someone who, like you, is a fan of continuous reinvention (#NotYoungNotDone).

Sherry makes herself available at a fraction of the cost of a financial planning engagement to fill a gap between the market need and what services/professionals are available.

Join Here: www.madrinamolly.com

(Psst: That’s the membership. The Substack is free.)

Only 16% of BoomX Women Say They Have Received Financial Education*

That’s not acceptable. For years, women have been reaching out to Sherry for financial advice and planning assistance. You have been:

Stressed and ashamed that you somehow missed the memo on how to manage money.

Ready to make yourselves wrong when you seek advice. (Seriously, the women Sherry meets are quick to begin the conversation with, “I’m sure you’re going to tell me my financial management is terrible.”)

Scared that you won’t be able to continue working long enough to fund your retirement.

Worried that you’ll need to work forever to fund your retirement.

Ping-ponging from children to work to parents without time for yourself.

Angry that media, marketers, and institutions think you’re invisible.

Madrina Molly™ wants you to have a place to go to read, ask your questions, confirm you are on the right track, solve problems, and achieve a lovely second 50 years.

Source:

* https://helpageusa.org/wp-content/uploads/2023/06/Report-V3-updated.pdf

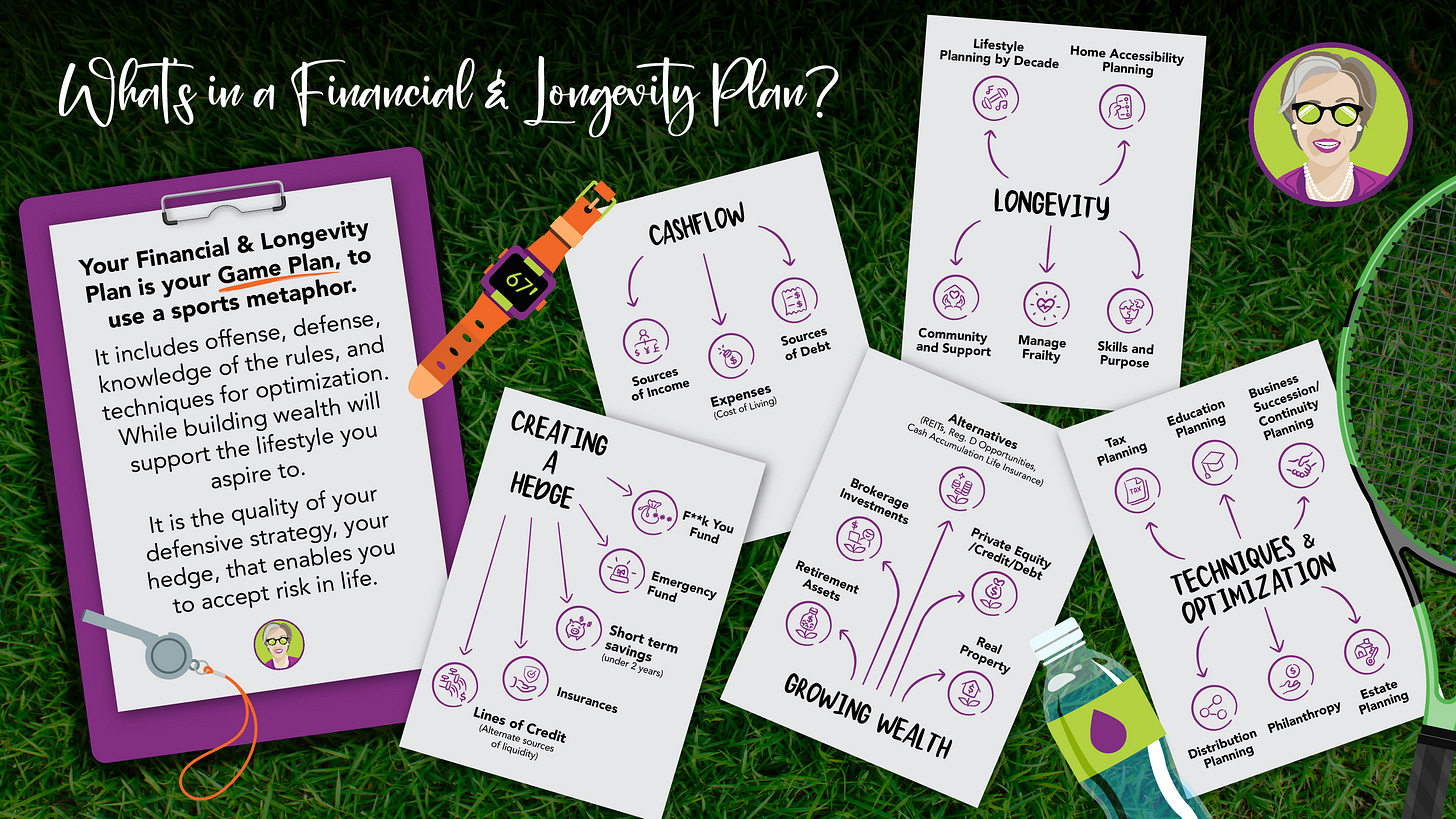

Why Financial *and* Longevity Planning?

Most Americans dramatically underestimate how long we will live. According to the Actuarial Life Tables (2021) used by the Social Security Administration for women, the average life expectancies are as follows:

Realize that these are averages. That means that 50% of you will live longer than your average life expectancy. As a matter of fact, if you were born in 1955 or later almost 2 of every 100 women will see their 100th birthdays.

What do you see? For starters, the older you get, the older you get! By the time you’re 65, you have a 50% chance of reaching 85(ish). And if you have longevity in your family and are in good health, you could easily stretch that to 95. (Sherry’s “still-kicking” 97-year-old mother had a mother who lived to 96 as well.)

If you’re 50 and have, on average, 32 or more years to live, what are you going to do with that time? Of course, you want to have enough money to last your lifetime. But you also want the skills to be able to use the latest technology, cooking tools, and entertainment media. You want to be able to communicate with your grandchildren. You want to be healthy for as much of your long life as possible, with the energy and strength to do what you want to do. You want all of that, don’t you?

That’s why, at Madrina Molly™ longevity planning is financial planning and vice versa. There’s always going to be change and there's always going to be a new new economy. And we, the Women of a Certain Age(ncy), are the ones to take advantage of it because we are #NotYoungNotDone and we all have #MoreRunwayThanWeThink.

Financial Planning best practice should be accessible.

Sherry recognizes that it’s hard to discern what is real and what is finfluencer clickbait or product sales masquerading as advice in financial services work. And that’s unfair to you. There are only 105,000 CFP® Professionals. Of these, under 25,000 are women. That means there simply aren’t enough credentialed financial planners to go around. And, while it’s well documented that women would prefer to work with women financial advisors, it’s not easy to find us. What’s more, because young CFP® Professionals need to build their practices, they may seek out the wealthiest clients or have minimums for investible assets or net worth. That leaves a lot of mass affluent households out in the cold.

Sherry can provide education and thought leadership to a larger audience, digitally. Members have access to Sherry Finkel Murphy, CFP®, RICP®, ChFC® and the mini-courses/resources she has put together.

This is how we will democratize and demystify the financial planning domain. Gatekeeping this information is wrong, especially for the cohort that will control $34 Trillion by 2030.

Sherry does not provide or broker financial solutions. She sold her practice portfolio 12/31/2023. All content is for educational purposes and does not constitute investment “advice.” (That’s a compliance statement. IYKYK) Sherry provides referrals to qualified financial professional for appropriate financial products.

Note to peer CFP® Professionals in the spirit of solving a known challenge:

I (Sherry) recognize your need to run profitable practices to enable you to fulfill your goals for yourselves and your families. I also recognize the need to protect your calendars so that you are booking the optimal number of planning appointments for your capacity and goals.

In that spirit, I am happy to work with your clients who are not quite ready for your services, answering questions and giving them confidence until they are ready to work with you. Similarly, if you have clients for whom you have done your best work and their need is to maintain an existing course of action, I am happy to be a resource for them if you need to schedule less frequent check-ins.

I will return the courtesy as Madrina Molly™ subscription members require more service. Let’s spin up a Zoom and see how we can help one another.